[Hui Cong Pharmaceutical Industry Network] Recently, Arterial Network learned from the Wall Street Journal that the retail giant is preparing for the acquisition of the medical insurance company Hubana.

In fact, the pace of Wal-Mart's expansion has not stopped for many years. But regardless of vertical mergers or horizontal expansion, Wal-Mart's expansion has never crossed the boundaries of vertical industry. This makes the selection of the medical service field as the target of Wal-Mart as a target of self-denial. So how do you interpret this acquisition? Let's start with the changes in the medical industry.

The medical industry is changing, who is the spoiler?

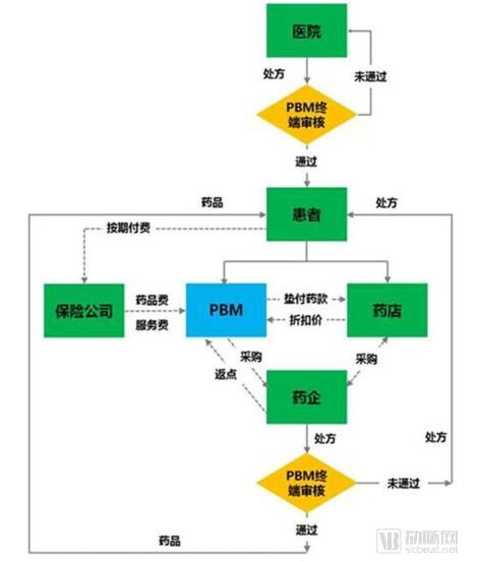

First look at a set of data, according to CBInsight statistics, the annual medical care costs in the United States reached 3.5 trillion US dollars. The United States is a highly market-oriented country, and marketization has swept across all walks of life, including medical health. In the United States, the medical industry is centered on medical welfare management (PBM). Hospitals, pharmaceutical companies, and medical insurance operate efficiently under the coordination of PBM, providing Americans with efficient, low-cost health services.

Humana, which is about to be integrated into the Wal-Mart territory, started out as a medical insurance, and also involved in PBM. Aetna Insurance tried to acquire Humana as early as 2015, but it ended in failure.

In the face of the huge cake in the health care industry, market participants are naturally unable to sit still. In a developed market economy, an oligarch who does not want to be a monopoly is not a good company. After a round of integration, pharmacies, medical insurance and PBM in the United States have formed a highly concentrated market structure. However, the emergence of the Internet has weakened the boundaries of all industries. So the medical industry staged another cross-border integration drama.

First, at the end of 2017, CVS Health Group plans to acquire Antai Insurance at a price of US$69 billion, forming a cross-border of “pharmacy + medical insuranceâ€. Then, in early 2018, Amazon announced that it would establish a medical company with capital giants Berkshire Hathaway and JP Morgan Chase to provide medical-related services to employees. The move is seen by the outside world as a sign that Amazon will enter the medical industry. Subsequently, CIGNA Health Insurance plans to merge with the Pharmaceutical Welfare Manager (PBM) ExpressScripts for $54 billion to form a cross-border of “Medical Insurance + PBMâ€. In all of these cross-border integrations, all parties to the transaction stated that they intend to provide better medical services at a lower medical cost through in-depth cooperation. In other words, once the deal is reached, it will inevitably have a major impact on the US medical industry.

You may have to ask here, what is the medical industry, and what is the store with Wal-Mart, our department store? This question arises that you do not know another identity of Wal-Mart.

Wal-Mart set up its first store in Arkansas in 1962. It was listed on the NYSE in 1972. In 1988, it became the largest retailer in the United States. By 2018, it has become the world's largest retailer, the largest private employer, and the world's top 500. Ranked first in the enterprise.

However, what about Wal-Mart pharmacies?

For more than half a century, you know that Wal-Mart is a place where you can buy a variety of goods, and Wal-Mart, which you don't know, is one of the largest chain pharmacies in the United States, and has opened more than 4,700 retail pharmacies across the United States.

Love vertical field, Wal-Mart presents obvious path dependence

At the end of 2017, data company CBInsights had sorted out the acquisition of US chain drugstore giants, including Wal-Mart.

According to CBInsights, for many consumers, pure local pharmacies have long ceased to exist, replaced by large retailers with stronger financial strength and higher brand awareness. Today, the top four chain pharmacies in Wal-Mart, Walgreens, CVS Health Group and Laidei have operated more than 25,000 retail pharmacies. CBInsights compiled the 2012-2017 M&A data and found that among these chain drugstore giants, Wal-Mart's acquisitions occurred most frequently, but Walgreens was really active in the medical industry.

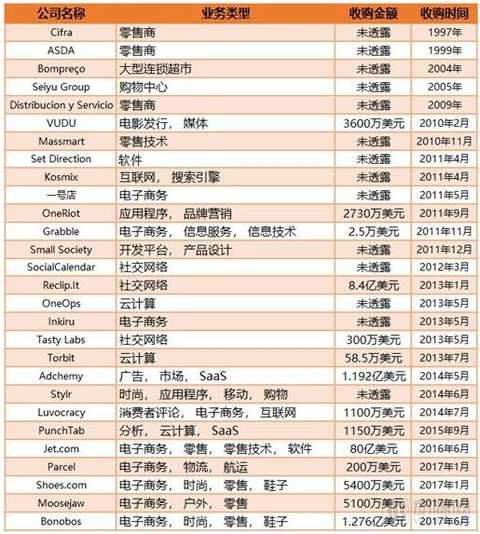

Drawing on the ideas of CBInsights, Arterial Network will summarize the Wal-Mart acquisition cases that can be collected through open channels. Since 1999, Wal-Mart has made a total of 28 acquisitions, the largest of which was in June 2016, the acquisition of e-commerce Jet.com for $8 billion.

Through all 28 acquisitions, Wal-Mart has integrated retailers, supermarket chains, shopping malls, e-commerce, social platforms, cloud computing and information service providers located in Japan, China, Mexico, South Africa and Chile. Rich, but Wal-Mart seems to be just trying to be a retail giant.

Data organized by arterial network

Wal-Mart also recently announced that it will invest more than $500 million over the next three to five years to build 50 new stores across India.

From these buying and buying behaviors, the medical industry companies do not seem to be the ideal target of Wal-Mart. So Wal-Mart Pharmacy just wants to be a pharmacy quietly? The answer is really no.

One of the most intuitive rebuttals is that in 2014 Wal-Mart once said: “Our goal is to be the leading healthcare provider in the industry.†Wal-Mart has been preparing for the health care industry in the past decade, and some of them have been fruitful. jobs.

Prescription plan: Wal-Mart offers consumers a prescription of $4 to help them reduce their cost;

Health care convenience: Wal-Mart provides health advisory services to consumers at the store, for a fee of only $40;

Primary clinic: Consumers can conveniently get a common prescription at Wal-Mart through a clinic set up in the store, for as little as $40 each time;

Medical insurance consulting: In the United States, consumers face a wide variety of medical insurance options, making selection difficult. Since 2014, Wal-Mart has partnered with DirectHealth.com, a licensed agent that provides healthcare insurance transaction advisory services to consumers at Wal-Mart stores.

In addition, Wal-Mart's most concerned operation in healthcare is actually in collaboration with Humana.

Since October 2010, Wal-Mart and Humana have teamed up to serve MedicarePartD. Medicare is a US medical insurance program for people over the age of 65. In 2012, Wal-Mart and Humana reached an agreement to offer exclusive discounts on health foods to some of Humana's customers at Wal-Mart stores.

It can be said that the cooperation with Humana has made Wal-Mart a deep participant in the medical industry, not just a pharmacy owner.

There is also a slightly retorted rebuttal that can be found in the earnings conference call in recent years.

In the third quarter of 2017 earnings conference call, Humana CEO Brian Kane pointed out that the "Wal-Mart Low Price Plan" was one of the few highlights of the quarter-finished Human Alternative Pill Program (PDP) business. He said: "Although we are satisfied with the expected growth of the business with Wal-Mart, in 2018, we have independent PDP business, there is indeed some competitive pressure. As you may know, Humana provides three PDP plans, including Serving low-income members' basic health plans, enhanced health plans and Wal-Mart low-cost plans, the extraordinary growth of the low-priced Wal-Mart program has made us the nation's leading personal PDP operator."

In the fourth quarter of 2017 earnings conference call, Brian Kane once again mentioned the Wal-Mart low-cost plan. He pointed out that Wal-Mart's low-cost plan mail order usage rate is the highest compared to other PDP products, but as competition intensifies, Wal-Mart's low-cost plan's performance growth is relatively weak. “From a M&A perspective, we continue to focus on strategic acquisitions to enhance our capabilities, especially in the primary care sector, but we are constantly looking for any other assets that will enhance our healthcare services. In addition, we will also have MedicareAdvantage assets. Interested in increasing our share of the imperfect market."

This shows that Humana attaches great importance to the cooperation with Wal-Mart and believes that it is necessary to improve the cooperation model to cope with industry competition.

The deep cooperation between the two sides is coming out.

Wal-Mart: To be a one-stop service provider

In fact, Wal-Mart's 2014 Declaration still has a paragraph, “We will continue to enrich our categories and provide diversified services to educate our customers. Wal-Mart is a provider of one-stop services.â€

Deeply ploughing the vertical industry, Wal-Mart is moving towards a large and comprehensive one-stop service provider. If we portray Wal-Mart's customer image, we will find that the medical service sector should be an important part of one-stop service. Based on data from KantarRetail's ShopperScape, we can abstract Wal-Mart's customers as a white, 51-year-old woman with an annual family income of $56,482. The Wal-Mart customer is a long-term, relatively economically disadvantaged population in the US population structure, which will form a Wal-Mart-specific market segment. Providing low-cost, high-efficiency medical services is what Wal-Mart should provide for a one-stop shop for its market segments.

At this point, we can roughly understand the event of Wal-Mart's acquisition of Humana.

We believe that it should not be an emergency risk-avoiding behavior of Wal-Mart in the face of the Internet wave, nor is Wal-Mart trying to subvert the medical industry. It is not that Wal-Mart is self-denying and changing the track. It actually marks the further clarification of Wal-Mart's positioning. It is a step that Wal-Mart must take to become a one-stop service provider.

In the future, as an important part of the one-stop service provider layout, the high probability of mutual penetration of Wal-Mart and the medical industry will advance in depth. Recently, Wal-Mart and PillPack conducted an acquisition negotiation to prove this. The latter is a pharmacy sorting and distribution service provider that, when integrated, will better serve Wal-Mart's customers and help streamline its retail pharmacy business.

Editor in charge: Yang Manman

Fashion Soft Knit Onesies.

The onesies knitted with silk and cotton have a very good feel, are very breathable, breathable and comfortable to wear on the body. It is a very good-looking onesies and suitable for all ages.

It is also a versatile onesies that can be matched with a variety of trousers and shoes in the spring, summer and autumn seasons. It looks very fashionable and popular.

Onesies For Girls,Fashion Knit Onesies,Women Onesie,Kids Onesie

Yangzhou Youju E-commerce Co.,Ltd , https://www.yzxygarment.com

![<?echo $_SERVER['SERVER_NAME'];?>](/template/twentyseventeen/skin/images/header.jpg)